10 reasons

Contrary to popular belief, getting professional advice on finances does not have to be overly complicated, nor is it reserved for the financially elite.

In fact, getting your financial assets looked over by a financial advisor is one of the absolute best things you can do for both your present and your future, and it doesn’t require you to whip up any fancy reports.

Instead, financial planners do all the heavy lifting for you, helping you understand the value of your assets and investments.

Even better, it doesn’t matter if you have prior financial experience or absolutely none at all – there is a financial advisor for every kind of individual out there.

Here the top ten reasons why will you benefit from meeting with a financial advisor to assist you with each and every one of your goals and dreams:

1) Profitable Budgeting

While you may have a monthly budget already squared away, financial advisors can take your finances a step further by helping you craft a budget that grows your wealth instead of keeping you at the same level for the rest of your life.

In meetings, advisors go over your expenses and take a look at your savings to create the optimal budgeting schedule to achieve profitable results.

Making the right budgeting decisions can help you achieve a level of wealth that will allow for a higher quality of life both in the near future and further down the road.

Moreover, advisors can give you a fresh financial perspective on what you do spend your money on. By understanding the advantages and disadvantages of what you do spend your finances on, you can make healthier financial choices, in general, to further grow your wealth.

This can help mend your relationship with money overall, no matter what it was like in the past.

2) Dependable and Educated Advice

The internet may have plenty of resources on finances, but you take the risk of receiving poor advice from unknown sources by completing your research online.

Even scarier, there are plenty of scams online that attempt to trick you into terrible financial situations.

This can lead to the loss of money and other assets as well as poor financial standing overall. Financial planners have years of education and experience helping a large variety of individuals of all net worths make sound financial choices.

In addition, advisors are required to have certain certifications and training in order to practice, making them thoroughly knowledgeable about a vast range of financial topics.

Advisors also have experience in what to do in situations where things go wrong, which is even more valuable than experience when things are going well.

This will greatly work in your favor if you meet a roadblock in your financial planning and need guidance on how to get back on track. After all, advisors have seen and resolved issues of all financial kinds.

3) First-hand Market Knowledge

The financial market can be a confusing and challenging place. There are always trends that change, as well as many ups and downs. Therefore, attempting to take on the market by oneself can lead to less-than-desirable results.

However, all financial planners are market-savvy and well-versed in how to handle changes as they occur. They keep track of the market and know the best times to buy and sell so that you remain in a position of profit and never in a place of failure.

This is essential in situations where the market is particularly volatile, which has been the case in recent years. During hardships, it’s important to know how to work strategically in the market instead of trying to work against it and receive large financial blows. Working with someone passionate about the market will reflect in the state of your financial portfolio.

4) Evaluation of Risk

Some people are risk-takers, while others would prefer for their financial assets to remain as steady as possible. There are advantages and disadvantages to both personality types, but most people will lean one way over another.

In a meeting with your financial planner, they will evaluate the level of risk you are comfortable with and guide you on making choices that match that level.

They inquire about how you view various aspects of your finances, including what you are comfortable risking or not. Advisors ensure that you never leave your comfort zone and are there to help guide you in all financial situations, good or bad.

If you do decide that you want to change your attitude towards risk over time, your advisor can work with you to adapt your finances to meet that level of risk.

Fortunately, from the get-go, nothing will be set in stone, and you can change your goals as your financial situation grows.

And, no matter the result of the change you take, your advisor will still be available to guide you every step of the way.

5) Selection of Proper Investments

When it comes to investments, you will have a lot of different options to consider taking on, including various kinds of funds, bonds, and stocks.

Financial planners assist you in choosing investments that diversify your financial portfolio so that you aren’t just stuck depending on one kind of asset.

If you already have some investments picked out, but your portfolio remains unfavorable, your advisor can help you streamline your investments into a portfolio that works for you and not against you.

It’s important to remember that taking on financial investments on your own also comes with the possibility of investing in something that will come back to bite you or bring nothing to the table at all.

Advisors are well aware of what efficient and inefficient investments are out there and only work to help you get the efficient ones.

6) Thorough Retirement Preparation

Many people don’t think of their retirement until it is looming near. Unfortunately, in doing so, they are met with financial difficulties just when they require financial security the most.

They may find themselves having to work for even longer or having to make financial sacrifices.

By meeting with a financial advisor as early as possible, you will set yourself up for a safe and secure retirement that is 100% stress-free.

There are a variety of retirement plans out there, but not all of them will be a perfect match, which is where advisors can help make the best choice for you.

For instance, some companies offer retirement plans, such as 401(k) plans, but perhaps you don’t work for one that offers this. Instead, you could look into an individual IRA, such as a ROTH IRA.

Of course, while these are great choices in themselves, there are plenty more options than just these two, giving you many chances to explore.

You’ll also talk with your advisor about how you want your retirement to look. For instance, some may want to spend their golden years traveling, while others would just like to relax in a nice home.

As such, different retirement accounts will be needed for these two different goals.

7) Accountability

Even the most well-prepared individuals may find themselves a little off track at some point. It may be due to unexpected financial situations that pop up and require you to spend more, or perhaps you find yourself a little behind on debts or other expenses.

Advisors will be your ideal third-party candidate to advise you on what steps to take when these inevitabilities do occur so they don’t lose track of your progress. This is especially useful if you are juggling several different kinds of debts and need to manage your cash flow better.

On a broader scale, advisors can hold you accountable if you find yourself slipping with general spending or saving in a helpful and encouraging way. As advisors are a third-party, they are able to support you in a more neutral way than friends or family might.

In fact, a common issue with many individuals is taking financial advice from family or friends who are not in good financial standing themselves. This can often hurt your own finances in a very negative way that can have a lasting impact.

8) Family Protection

Of course, a huge benefit to any kind of money planning is knowing that your family will be taken care of down the line. Whether it’s by securing a life insurance plan or setting up a fund to help pay for your kid’s college or future house, you can rest assured knowing that your finances will go where it matters most.

In addition, with an advisor, you will have a beneficiary officially in place, saving potential financial trouble for your loved ones. Your advisor will know exactly what to do in case an emergency situation does occur.

It’s also helpful to have someone handle these topics from a professional standpoint, as they can be perceived as sensitive topics. Advisors work with you on a confidential and protected level so that you can make decisions in a secure way.

Privacy is also highly regarded when meeting with and sending messages to a financial advisor, a huge bonus of working with financial professionals.

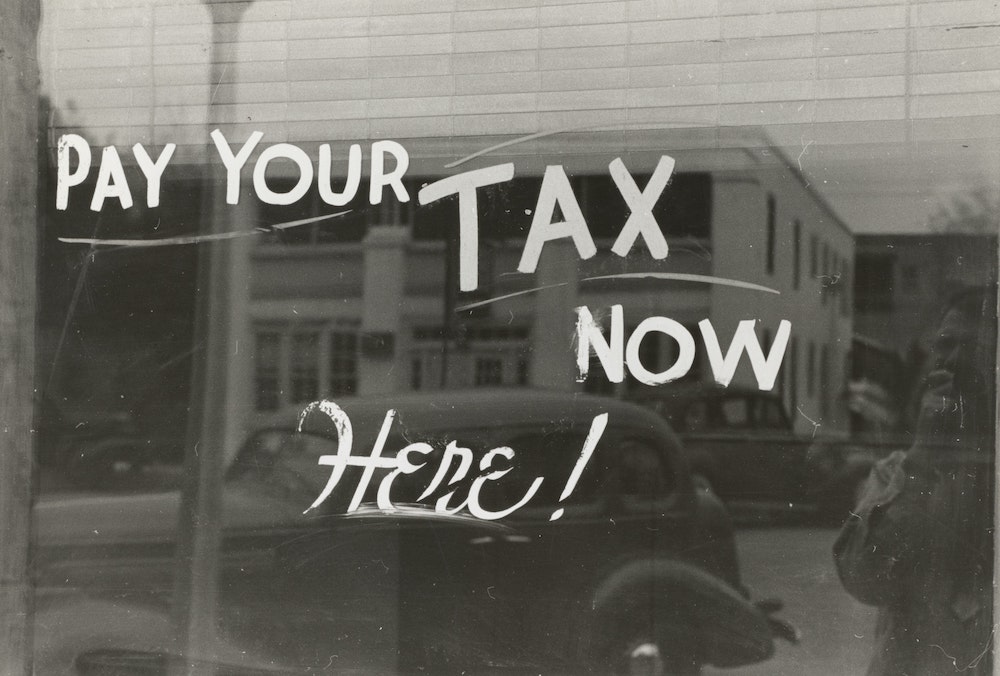

9) Proper Tax Planning

While everyone does taxes, not everyone knows how to maximize their tax savings. And, if done right, tax savings can be huge. Advisors know all about the tax structures, including little-known deductibles and ways to avoid any tax penalties.

Missing filling out a necessary tax bracket can lead to enormous troubles that you can easily avoid. Every single year, your advisor can help you get the best deal out of your taxes, no matter how your financial situation changes over time. You will save yourself plenty of time and headaches this way.

If you have your own business, this will be a huge benefit for you as well. Navigating the small business world of taxes can certainly be complicated and frustrating. With a financial advisor, you can have peace of mind knowing that you won’t miss out on any big, important steps and won’t have to face any legal troubles.

On the other hand, if you are in the planning stages of a new business, having a financial advisor on your side from the beginning can lead to the creation of an organized, efficient, and healthy financial business plan.

10) Achievement of Goals and Dreams

If you have a dream, financial planners are there to help you get it. Planners ask you about both your short-term and long-term goals, all the way up to how you see yourself in your 70s.

They will develop the best strategies for you to get everything you ever wanted without worrying about how to actually get there.

Then, to ensure you stay on track of meeting your goal, they will include the goal as part of your portfolio and show you progress over time to show you just how on track you are.

Oftentimes, we may let our desires and wishes take over our financial planning and security. Advisors are able to view your goals from an objective perspective so that you don’t get offset by a decision ruled by your heart rather than your head! It all comes back to advisors having the ability to hold you accountable when you need it most.

A Financial Advisor IS For You

Securing a financial advisor is the best way to ensure that your future self will be financially stable and happy.

Moreover, financial advisors can help individuals in less-than-desirable situations overcome their financial difficulties or debts in a safe and healthy way for their bank accounts. Therefore, the earlier you get started, the better off you will be for the rest of your life!

Fortunately, there are plenty of advisors located all across Canada that can help you with your every financial need. Finding the right advisor for you is simple as a few clicks online.

After reserving an appointment with an advisor, you can get an expert evaluation and find the next steps to take. Get ahead today and create a brighter tomorrow!